Bunching Strategy for Charitable Giving

November 17, 2022

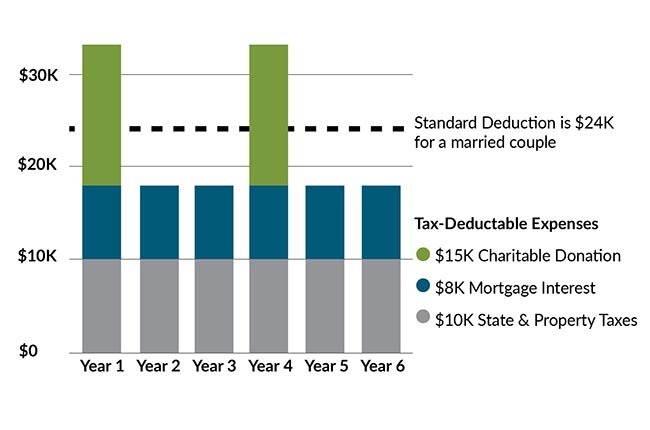

Since the standard deduction was doubled in 2018, many donors may no longer collect the necessary deductions to surpass the new standard deduction threshold. A tax-smart strategy to overcome this is called “bunching,” where a taxpayer groups together deductions into a single tax year in order to surpass the itemization threshold. In off-years, taxpayers can take the standard deduction.

Bunching with a Donor Advised Fund

Gifts to donor advised funds are tax deductible. You can combine two or three years of charitable contributions in order to exceed the new, higher standard deduction in a given year. Bunching multiple years’ worth of donations in a single year allows you to receive maximum tax benefits for your charitable contributions.

Giving Over Time

Although you will not make charitable contributions each year using this strategy, you can still support your favorite charities on “off” years. The assets in your donor advised fund will be available to you so you can make grant distributions even in the years when you don’t contribute to the fund. Funds that are not distributed as grants will continue to be invested by CFNEIA so your charitable dollars can grow tax-free.

Example Graph Above: This scenario shows how a married couple, filing jointly, who typically give $5,000 a year to charity can benefit from bunching their charitable donations. This is accomplished by contributing $15,000 to a donor advised fund every three years. In this example, the donors itemize in years one and four and takes the standard deduction in years two, three, five, and six, giving them an additional $18,000 in tax deductions over the six year period.

Contact our development staff to learn more about this stratetgy, or click here to start your donor advised fund online today!