Resources

“Shell funds” and other handy tools for charitable clients planning ahead

Resources

“Shell funds” and other handy tools for charitable clients planning ahead

Getting a jump on a future “to do” list is always such a good feeling. The team at the Community Foundation can help you with your clients’ long-term charitable giving plans by putting in place...

Read Story

Resources

Year-End Giving Dates

Resources

Year-End Giving Dates

As we enter the holiday season and the final days of 2022, the Community Foundation of Northeast Iowa is ready to assist you with your end of year giving and grantmaking. In order to provide...

Read Story

Resources

Benefits of Giving a Gift of Stock

Resources

Benefits of Giving a Gift of Stock

When considering a charitable gift, most people think of writing a check and may overlook other assets that allow them to provide greater support for the causes they care about. Gifts of publicly traded stock...

Read Story

Resources

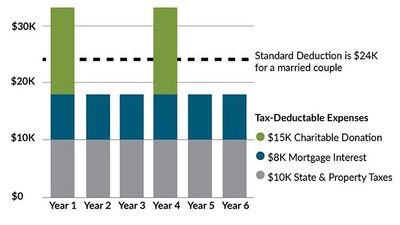

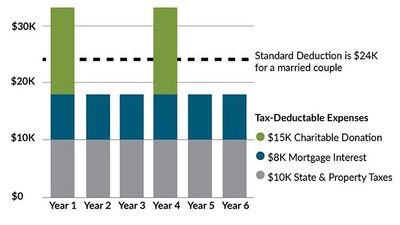

Bunching Strategy for Charitable Giving

Resources

Bunching Strategy for Charitable Giving

Since the standard deduction was doubled in 2018, many donors may no longer collect the necessary deductions to surpass the new standard deduction threshold. A tax-smart strategy to overcome this is called “bunching,” where a...

Read Story

Resources

Financial Planning Month, Estate Planning Week Prime Time to Create a Personal Plan and Will

Resources

Financial Planning Month, Estate Planning Week Prime Time to Create a Personal Plan and Will

October is National Financial Planning Month and National Estate Planning Awareness Week is October 17-23, calling attention to what estate planning is and why it is an important component of a personal financial plan. Less...

Read Story

Resources

Harvest Season Yields Opportunity for Farmers to Give Back Through Gift of Grain

Resources

Harvest Season Yields Opportunity for Farmers to Give Back Through Gift of Grain

With harvest season upon us, the Community Foundation of Northeast Iowa (CFNEIA) wants farmers to know about and to consider the opportunity to benefit their local community through a gift of grain. Donating a gift...

Read Story

Resources

Higher Quality of Life Points to Greater Economic Health for Communities

Resources

Higher Quality of Life Points to Greater Economic Health for Communities

Summer is in full swing and there are many things that make Iowa summers so great. From hitting the trails to cooling off at the public pool to attending farmers markets, county fairs, and other...

Read Story

Resources

CFNEIA shares support of Mental Health Awareness Month, Black Hawk-Grundy Mental Health Center Shares Insight

Resources

CFNEIA shares support of Mental Health Awareness Month, Black Hawk-Grundy Mental Health Center Shares Insight

In support of Mental Health Awareness Month, the Community Foundation of Northeast Iowa is recognizing awareness and resources to end the stigma. CFNEIA strives to strengthen our communities, improving quality of life and supporting people...

Read Story

Resources

Oct 18-24 is National Estate Planning Awareness Week; Estate Plan Is Avenue for Charitable Good

Resources

Oct 18-24 is National Estate Planning Awareness Week; Estate Plan Is Avenue for Charitable Good

October 18-24 is National Estate Planning Awareness Week, a time to call awareness to what estate planning is and why it is an important part of a personal financial plan. According to Gallop’s spring 2021...

Read Story

Resources

“Shell funds” and other handy tools for charitable clients planning ahead

Read Story

Resources

“Shell funds” and other handy tools for charitable clients planning ahead

Read Story Resources

Year-End Giving Dates

Read Story

Resources

Year-End Giving Dates

Read Story Resources

Benefits of Giving a Gift of Stock

Read Story

Resources

Benefits of Giving a Gift of Stock

Read Story Resources

Bunching Strategy for Charitable Giving

Read Story

Resources

Bunching Strategy for Charitable Giving

Read Story Resources

Financial Planning Month, Estate Planning Week Prime Time to Create a Personal Plan and Will

Read Story

Resources

Financial Planning Month, Estate Planning Week Prime Time to Create a Personal Plan and Will

Read Story Resources

Harvest Season Yields Opportunity for Farmers to Give Back Through Gift of Grain

Read Story

Resources

Harvest Season Yields Opportunity for Farmers to Give Back Through Gift of Grain

Read Story Resources

Higher Quality of Life Points to Greater Economic Health for Communities

Read Story

Resources

Higher Quality of Life Points to Greater Economic Health for Communities

Read Story Resources

CFNEIA shares support of Mental Health Awareness Month, Black Hawk-Grundy Mental Health Center Shares Insight

Read Story

Resources

CFNEIA shares support of Mental Health Awareness Month, Black Hawk-Grundy Mental Health Center Shares Insight

Read Story Resources

Oct 18-24 is National Estate Planning Awareness Week; Estate Plan Is Avenue for Charitable Good

Read Story

Resources

Oct 18-24 is National Estate Planning Awareness Week; Estate Plan Is Avenue for Charitable Good

Read Story